As short-term/execution-only traders, it is easy to get caught in the moment and overlook the broader picture regarding investments and their historical movements. While trade execution is obviously critical and timing essential, it is also vital to have the courage of your convictions. As an execution-only trader, you must know historical asset price movements and how this may impact relative valuations and future movements.

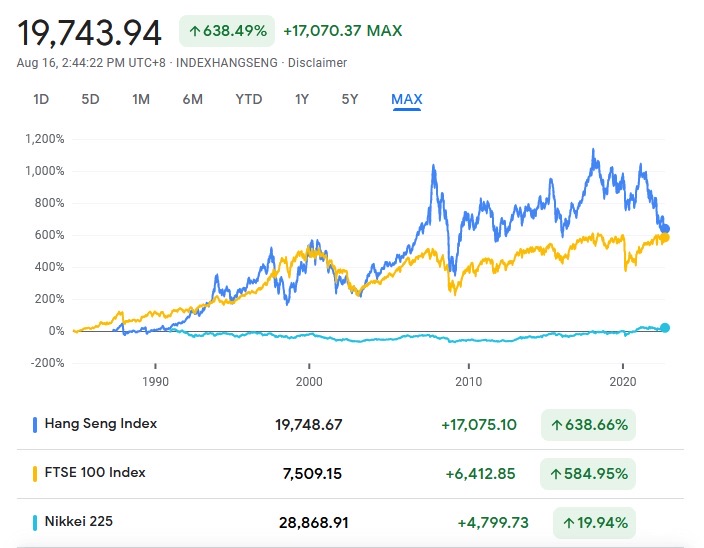

As you can see from the graph below, while the Covid pandemic has disproportionately impacted the Hang Seng index, it has still outperformed the FTSE 100 and the Nikkei 225 index in the long term. Indeed there have been times when the Hang Seng has outperformed the FTSE by almost 100%. However, in 2009 and 2022, the indices have come close to parity in relative performance terms, with the Hang Seng rebounding strongly in 2009. This has created significant trading opportunities for execution only investors, although the timing of trade execution is crucial. A few days or weeks between the peaks and troughs can result in a very different return.

The situation with the Nikkei 225 index adds a bit of reality to the situation, highlighting the Japanese asset price bubble bursting in the 1990s. Moreover, the economic challenges have been tough, with Japan encountering a sustained period of deflation and subdued economic activity. Indeed it is proving difficult to pull away from the spectre of deflation which has significantly impacted share prices.

As an execution-only trader, volatility and trade execution timing are critical elements which are prevalent on the Hang Seng index graph. As we touched on above, the Covid pandemic has disproportionately impacted the index's performance. You can also see that the US sub-prime mortgage market collapse of 2007/8 led to a steeper fall in the Hang Seng compared to the FTSE 100. However, after a period of consolidation, the Hang Seng index recovered sharply and went on to outperform the FTSE 100 yet again, until just before the outbreak of the pandemic.

There is no doubt that the Connect trading system, which allows Chinese companies to have secondary listings in Hong Kong, is having a significant impact. We know overseas investors and execution-only traders in the region are taking advantage of increased liquidity and global exposure. To all intents and purposes, Hong Kong has become the bridge between international investors and China, a relatively untapped market in many areas.

If you look at the 12-month performance of the Hang Seng index against the FTSE 100, putting the Nikkei 225 aside for one moment, you may get the wrong impression. It is essential to look at the wider situation, the broader trend lines and the impact of issues such as the US sub-prime mortgage crisis and Covid. While time will tell, history suggests that the eventual rebound in the Hang Seng could be relatively strong if past trends are anything to go by.

Back to News